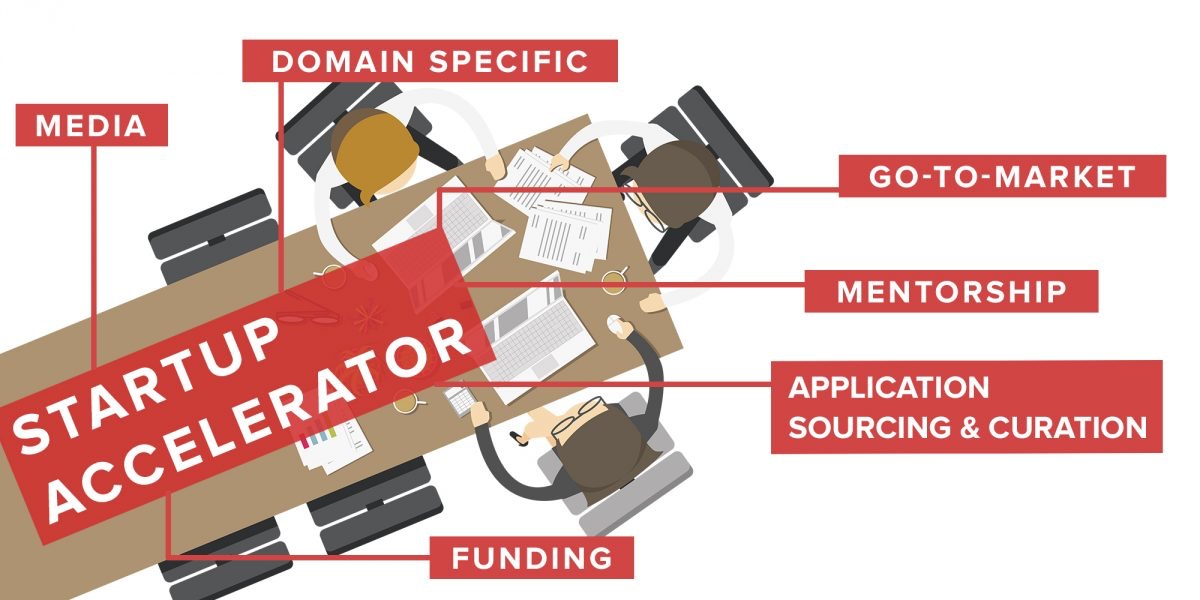

Corporate startup accelerators are able to successfully achieve repeatability and stability of basic operations, curriculum, internal team structure, roles & responsibilities and selection criteria after managing 2-4 cohorts of startups in their program. However, I have observed time and again that the same accelerators do not dedicate enough mindshare and resources to partnerships, one of the most important elements for an accelerator’s success (see list of biggest mistakes new accelerators make).

Here’s a list of key partnerships an accelerator needs in order to improve the odds of success of their startups and hence the program.

1. Application Sourcing: A PR article in leading newspapers, a couple of newsletters to your subscribers and request for referrals just doesn’t cut it. For one, it brings in hundreds of poor quality applications, and two, it does not reach the startups that are relevant for your program. The aspirational goal of the program should be to reach the complete universe of ‘relevant’ startups. LetsVenture has over 14000 startups registered; F6S and Gust have a large number of founders from across the world using the platform; major ecosystem enablers like NASSCOM 10000 Startups, TiE (city chapters), T-Hub etc. have a large startup alumni base perfect for referrals. Some of these online platforms may want to bundle application hosting and sourcing, while some of them may simply want to be a sourcing partner. Further, they may provide an algorithmic curation where they are able to weed out the poor quality applications and provide the complete list with associated curation score. This will not only save the evaluation bandwidth of your team, but also provide the most relevant startups first to enable deeper engagement. The more such partnerships there are, the better is the quality of your applications.

2. Mentorship: Irrespective of whether the program is staffed and run by your full time employees or by an operator firm you have hired, the cohort startups need a constant influx of new perspectives and real industry experience. Typically the mentorship requirements fall into to buckets – technical and business. Can you get technical mentors from your ranks (India & global operations)? Can you invite experts in the field to run workshops or even better, engage one on one with your startups? Can you get other entrepreneurs who have created business model innovations? Are there CTOs / subject matter experts who can run ‘office hours’ once a fortnight when the cohort startups can clarify the doubts they have listed? There may not be large organizations with whom you may partner for this purpose, but the answer lies in finding the right people and inviting them over. You’ll be surprised at how many experts are generous with their time – they are keen to engage with startups but don’t know where to start. Of course, remember to put contractual guardrails on these mentoring relationships to protect the interests of the startups.

3. Funding: Let’s face it – in the short-term, the success or traction of the program is measured by how many of the cohort startups went on to raise funding 6-12 months after graduating from your program. Only in the long-term, the number of customer wins, unit economics and profitability come into play in measuring the success of the program. Partnerships with online funding platforms such as LetsVenture (2300+ angels, 300 funds), offline angel networks such as IAN, Mumbai Angels, The Chennai Angels, and informal groups of investors that invest together are absolutely essential. Further, engagement with these entities should not be restricted to the demo day when actual funding is sought. Find an overlap of these investors who may also want to / have the expertise to mentor startups, as mentioned in the point above. It is a myth that there is going to be ‘one big pitch’ during the demo day that will blow away the investors and convince them to invest in the startups. The best investments happen when the investors and startups engage seamlessly over multiple touch points and over a period of time where they see the startups maturing from one interaction to the next and find a mutual cultural fit.

4. Media: Don’t leave the task of engaging with media to your PR agency or your internal corporate communication team. While I am not doubting their capability, any good journalist worth her salt would want to engage directly with the team running the program. Those are the journalists and media champions that are worth going after, so invest your time and effort in that direction. There is a whole spectrum of partnership formats that can be explored to suit your budget and inclination. From banner ads to native advertising to newsletter and social media outreach to offline events, media partnerships can take various forms. Most media entities allow you to pick from this buffet of potential outreach options or propose specific packages that include some or all of the above options. YourStory, Inc42, TechInAsia, NextBigWhat are some of the key media houses with a focus on entrepreneurs as their target segment. The larger media houses have a formal branded campaigns team who will work with you on finalizing the specific terms of the partnership. The smaller ones may not have a separate team, so building a relationship with the relevant journalist / author from the team will be sufficient to figure out the monetary aspects of the partnership.

5. Domain Specific: If you are a deep tech or block chain or Artificial Intelligence / Machine Learning or Augmented / Virtual Reality accelerator, there is a need for more specific domain expertise to be part of your plans. You may need to target service providers who are working on the technology (e.g., Persistent Systems for block chain) or other GICs in the space (e.g., Societe Generale for block chain in Bangalore) or research institutes (e.g., IBAB, C CAMP for medical research) or domain expert angel groups who can help evaluate startups (e.g., CIO Angel Network in Mumbai).

6. Go-To-Market: Startups in the program also need tremendous support in terms of taking their offering to a larger portion of the market. For B2B startups, that could mean a partner that can provide access to multiple enterprises. Platform companies like Microsoft, Google & Amazon can give access to their customers through their cloud stack sales and evangelism team. For B2C startups though, there may not be a single partner that can provide access to multiple B2C segments, but banks, mobile wallets and other such companies who have a large user base and are looking to drive adoption of certain behaviours will be the right targets to get access to a large user base.

The key message I would like to leave you with this. Partnerships with a host of ecosystem enablers is key to the success of your accelerator program. The beautiful part is that many of these partnerships may not even involve a monetary aspect – many of them work on a reciprocal basis. All it takes is dedicated effort from you in building and keeping those genuine relationships. So if you need to get a full time person focused on partnerships, it will pay for itself in gains for your program.